New Year’s Day Ushers in Historic Era as Zohran Mamdani Takes Office

Zohran Mamdani was officially sworn in as mayor of New York City on New Year’s Day, marking a historic and symbolic beginning to the city’s next chapter. Taking office just after midnight, Mamdani assumed leadership as one of the youngest mayors in the city’s history and the first Muslim and South Asian person to hold the role. The oath of office was administered in a quiet, unconventional ceremony held at a historic, decommissioned subway station beneath City Hall. Choosing the underground location over a traditional setting, Mamdani emphasized its connection to everyday New Yorkers and the city’s working-class roots. He placed his hand on the Quran while taking the oath, a moment that reflected both his personal identity and the city’s cultural diversity. Later in the day, a larger public inauguration was held on the steps of City Hall, drawing thousands of residents, supporters, and elected officials. The event carried a celebratory yet determined tone, as Mamdani addressed the crowd with a message focused on urgency, fairness, and bold action. In his inaugural remarks, he pledged to confront the city’s most pressing challenges, including housing affordability, rising living costs, public transportation access, and economic inequality. Mamdani rose to prominence as a democratic socialist with a grassroots-driven campaign that energized younger voters and working-class communities across the city. His victory signaled a generational and ideological shift in New York politics, breaking from long-standing establishment leadership. Throughout his campaign and into his first day in office, he framed his administration as one rooted in inclusion, accountability, and structural reform. As he begins his term, Mamdani faces significant expectations and challenges. Supporters view his leadership as an opportunity for transformative change, while critics question how his ambitious agenda will navigate political, financial, and institutional constraints. Nonetheless, his swearing-in on January 1 stands as a defining moment — not just for his administration, but for a city searching for renewed direction at the start of a new year.

Read More →

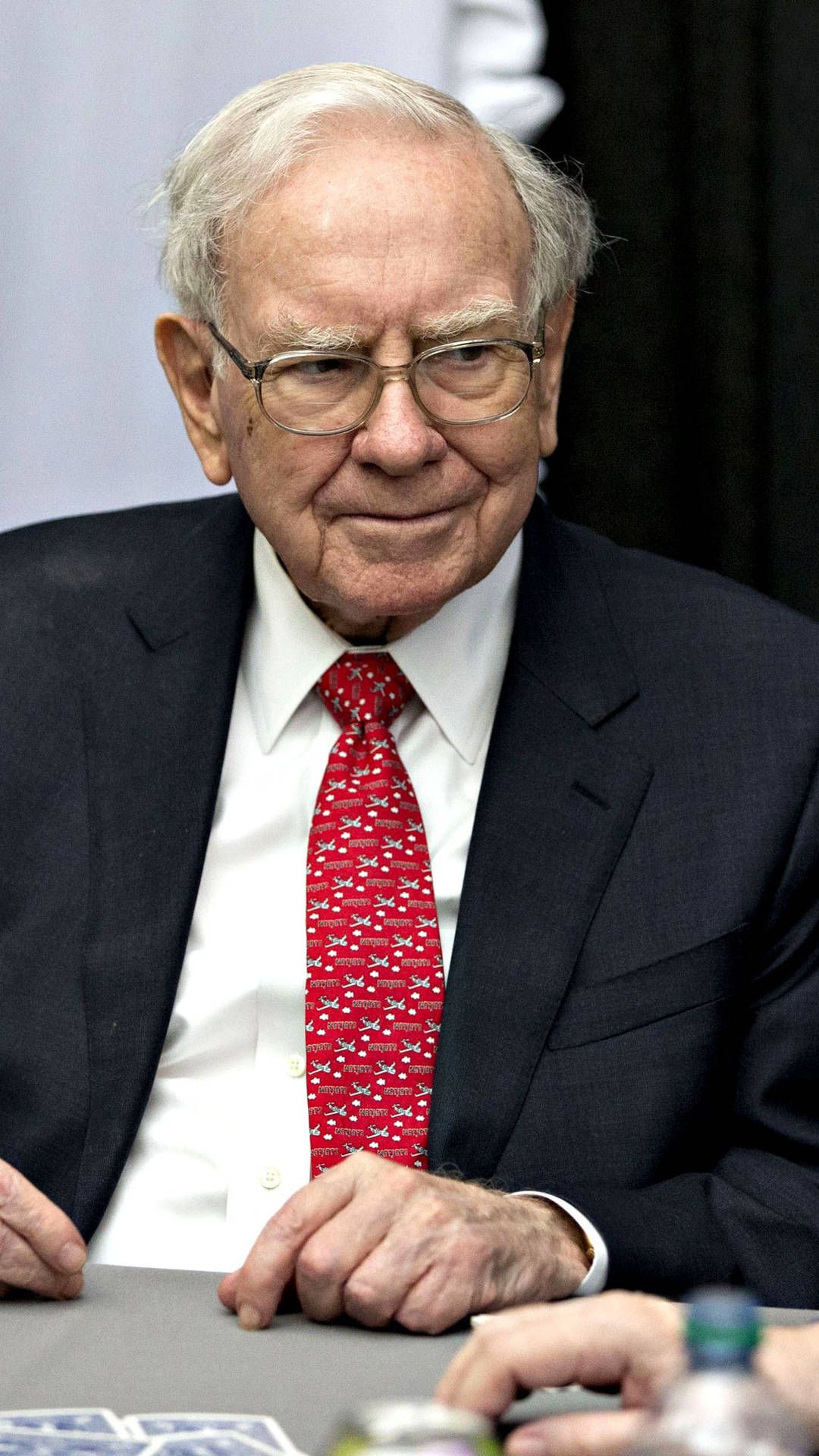

Warren Buffett Sits on Record Cash Pile, Signaling Caution Amid Market Euphoria

For decades, Buffett’s playbook has been simple: when markets panic, he buys; when they surge with excitement, he waits. Right now, he’s waiting — and that patience speaks volumes. Despite record highs in U.S. equities and a flood of optimism around technology, artificial intelligence, and consumer spending, Buffett appears unconvinced that current valuations offer a margin of safety worth pursuing. “We don’t see anything that makes sense to us right now,” Buffett said in a recent shareholder letter, underscoring his trademark discipline. “There’s no shame in waiting for the right pitch.” That stance has left Berkshire’s cash pile — roughly equivalent to the GDP of a mid-sized country — parked in short-term Treasury bills, generating modest returns but preserving flexibility for future opportunities. Why Buffett Isn’t Buying Several factors explain Buffett’s restraint. First, U.S. stock prices remain near record levels, driven by investor enthusiasm for artificial intelligence and resilient corporate profits. Many analysts believe valuations in sectors like tech and industrials have become stretched. Buffett, a value investor at heart, prefers to buy great businesses at reasonable prices — and right now, the market is offering few of those. Second, uncertainty about the broader economy lingers beneath the surface of optimism. Inflation, though cooling, remains above the Federal Reserve’s target, and interest rates are still high. Buffett has long warned that high borrowing costs and inflated asset prices rarely coexist peacefully for long. Lastly, the billionaire’s age-old skepticism toward market fads may also play a role. While much of Wall Street is chasing the next AI winner, Buffett is known for avoiding what he doesn’t fully understand — a discipline that has saved Berkshire from the crashes that follow speculative booms. A Lesson in Patience and Power Holding cash is not a sign of inactivity but of optionality. For Buffett, the ability to strike when others are fearful is his ultimate advantage. During the 2008 financial crisis, Berkshire deployed billions to rescue and invest in blue-chip companies like Goldman Sachs and General Electric, reaping massive profits once the market recovered. Analysts believe Buffett is now positioning Berkshire for a similar opportunity — waiting for prices to correct, or for panic to return, before deploying capital into undervalued assets. “It’s not that Buffett has lost his touch,” said one market strategist. “It’s that he’s waiting for everyone else to lose theirs.” Critics vs. Supporters Not everyone agrees with Buffett’s cautious stance. Some investors argue that sitting on such a vast amount of cash during a bull market is a missed opportunity, especially when even short-term bonds yield less than inflation-adjusted equity returns. Others counter that Buffett’s patience is precisely what separates him from speculators — a philosophy that has consistently outperformed over time. Indeed, Berkshire’s long-term record remains formidable. Over the past six decades, its stock has delivered returns that far outpace the S&P 500, even with periods of dormancy like the one seen today. Looking Ahead Whether Buffett’s caution proves prescient or overly conservative will depend on how the market evolves in the coming year. If valuations remain inflated and growth slows, his cash hoard could become a powerful weapon, allowing Berkshire to buy valuable companies at a discount. But if the market continues to climb, critics may grow louder, questioning whether Buffett’s ultra-cautious approach fits the new era of high-growth innovation. For now, the message is clear: in a world chasing momentum, Buffett is content to wait for value. As he’s often reminded shareholders, “The stock market is a device for transferring money from the impatient to the patient.” And with $180 billion in cash, Warren Buffett has never been more patient — or more prepared.

Read More →

Zohran Mamdani Appoints All-Female Transition Team in Historic First for New York Leadership

At a press conference in Queens, Mamdani introduced the team that will oversee the transition into his administration, describing it as “a reflection of the city we want to build — one guided by compassion, competence, and collaboration.” The announcement drew widespread praise from community organizations and political observers alike, many noting the historic nature of an all-women leadership group at the top levels of New York’s transition process. Leading the Team The transition effort will be headed by Elana Leopold, appointed as Executive Director. A seasoned strategist with years of experience in political campaigns and progressive movements, Leopold has been one of Mamdani’s closest allies in shaping grassroots policy efforts. Joining her as co-chairs are several powerhouse figures from across the political and civic spectrum: Maria Torres-Springer, a veteran public servant and former First Deputy Mayor of New York City, known for her extensive work on affordable housing and economic development. Lina Khan, the former Chair of the U.S. Federal Trade Commission, celebrated for her groundbreaking work on corporate regulation and technology oversight. Grace Bonilla, President and CEO of United Way of New York City, whose long career has focused on social equity and strengthening community-based services. Melanie Hartzog, former Deputy Mayor for Health and Human Services and once director of the city’s Office of Management and Budget, bringing deep financial and human services expertise to the team. Each of these women represents a distinct field of leadership, ensuring that the incoming administration is equipped with broad experience in governance, economics, law, and social policy. A Message Beyond Symbolism Mamdani emphasized that this decision is not simply symbolic but structural — a reflection of how he intends to govern. “These women are not here as tokens,” he said. “They are the ones who have already built and led systems that make this city function. Their expertise and compassion will guide every choice we make as we prepare to serve New Yorkers.” The move has been widely seen as an extension of Mamdani’s political ethos — one rooted in progressive ideals and people-centered policy. It also underscores a generational and cultural shift in New York politics, where gender balance and representation are becoming central to the vision of public service. Setting the Tone for Change Political analysts say the composition of Mamdani’s transition team sends a clear signal: his administration will prioritize collaboration over hierarchy and inclusivity over tradition. With key members who have led at both the city and federal levels, the team is expected to focus heavily on immediate issues such as affordable housing, cost of living, public transit, and social welfare expansion. Yet challenges await. Delivering on the ambitious promises that propelled Mamdani’s campaign — including rent freezes, expanded childcare access, and stronger corporate accountability — will test both the team’s coordination and the city’s capacity for reform. Still, the formation of this team has already set a new standard for leadership in New York. It reflects not just a shift in who leads, but in how leadership itself is defined. As Mamdani put it during his remarks, “When women lead, communities thrive. This is not just a transition of power — it’s a transition of perspective.” With this all-female transition team at the helm, Zohran Mamdani’s administration is poised to begin its tenure with a clear message: the future of New York will be built on inclusion, integrity, and the power of representation.

Read More →

Zohran Mamdani Secures Landmark Victory in New York Race

The Astoria-based lawmaker, known for his bold stance on housing justice, workers’ rights, and equitable taxation, secured a commanding lead that reflected both strong grassroots organizing and deep community support. Mamdani, who first made history as one of the few South Asian and Muslim elected officials in New York, has built his political identity around fighting for working-class New Yorkers. His latest victory speech captured the same energy that has defined his time in office — a mix of gratitude, defiance, and hope. Speaking to an energetic crowd of supporters, he emphasized that the win belonged not to a single campaign, but to a movement driven by ordinary people demanding change. Throughout the campaign, Mamdani faced significant challenges, including well-funded opposition and political pushback from establishment figures. Yet his consistent message — that New York must serve tenants before landlords and workers before corporations — resonated with voters frustrated by rising costs of living and inequality. Observers see Mamdani’s victory as more than a personal success. It signals a broader shift within the city’s political landscape, where younger, more diverse candidates are increasingly shaping the Democratic Party’s direction. His win may also embolden other progressives across the country, offering a blueprint for how grassroots organizing and clear messaging can overcome financial disadvantages. For residents of Queens, Mamdani’s continued presence in office represents a commitment to policies that center fairness, compassion, and inclusion. His victory is not just a moment of celebration for his supporters, but a reaffirmation that politics grounded in principle and community can still triumph in a system often dominated by money and power. As the cheers settled on election night, one thing was clear — Zohran Mamdani’s victory is not only a personal milestone, but a signal that New York’s progressive movement remains alive, resilient, and growing stronger.

Read More →

OpenAI × Amazon: a $38 billion bet that rewrites the rules of AI infrastructure

Snapshot: Deal size: $38 billion. Duration: multi-year commitment. Aim: Give OpenAI access to massive AWS compute (hundreds of thousands of GPUs and millions of CPUs) for training and running large models. Why it’s notable: OpenAI has broadened its cloud footprint beyond its prior exclusive alignment, marking a major strategic pivot for both OpenAI and AWS — and reverberating across the cloud industry. Why the number matters (and why you should care): That $38 billion figure is more than an eye-catching headline. It represents the scale at which modern AI operates: training cutting-edge models now requires industrial quantities of compute, specialized GPUs, dense networking and huge data-centre capacity. When a single company commits tens of billions just for cloud infrastructure, it changes incentives — for cloud vendors, chip makers, enterprise customers, startups, and even regulators. For users of generative AI, the tangible upside is straightforward: more compute can mean faster responses, larger context windows, more advanced multimodal capabilities, and better global availability. For investors and executives, it reframes the question: success in AI may depend as much on supply chains, data-centre capacity and partnerships as on model innovations. The strategic playbook behind the move Diversification and scale: OpenAI is reducing single-vendor dependence by expanding infrastructure relationships. That lowers concentration risk and gives it bargaining power to negotiate on both price and availability. AWS’s bid for credibility: Landing OpenAI’s workloads is a major branding and technical win for Amazon — it demonstrates that AWS can host frontier AI work at scale. Compute as battleground: The deal turns compute into an explicit competitive lever. Cloud providers now compete not only on features and price, but on who can deliver the most performant, specialized hardware where and when customers need it. What this looks like technically (plain language) OpenAI needs both training and inference capacity. Training a state-of-the-art model is extremely GPU-heavy and benefits enormously from low-latency networking and optimized data-centre stacks. Inference — the act of answering your prompts — scales differently but still needs distributed GPU clusters to serve millions of users with low latency. The AWS commitment promises ultra-dense GPU clusters tuned for AI workloads plus the CPU headroom to orchestrate and scale them worldwide. The economics and the risks Spending tens of billions on cloud compute assumes a future with massive recurring revenue from AI products and services. If demand scales as expected, the investment could be transformational; if it lags, it becomes a heavy fixed cost. There are additional risks: supply constraints for specialized chips, regional power and cooling limits, and the potential for competition to undercut pricing or lock customers with superior integrated stacks.

Read More →

Everything you need to know about the Trump Gold Card

What Is the Gold Card? The Trump Gold Card is a newly created immigration pathway designed for high-net-worth individuals. Under the program, a foreign national can obtain U.S. permanent residency (commonly known as a green card) by making a non-refundable contribution of $1 million to the U.S. Department of Commerce. If the applicant is sponsored by a company, the required contribution rises to $2 million. In return, applicants gain a streamlined route to lawful permanent residency — essentially bypassing much of the bureaucracy that typically comes with other visa types. There’s even talk of a higher-tier option called the “Platinum Card,” requiring a contribution of around $5 million, which would come with special tax advantages and greater flexibility in how long the holder can stay in the U.S. each year. Why This Program Exists The official explanation is that the Gold Card aims to “realign immigration policy with national interests” by prioritizing immigrants who can bring significant economic value to the United States. In simpler terms, the administration believes that attracting the wealthy will boost investment, create new business opportunities, and strengthen American industry — all while generating billions in revenue for the government. This approach replaces older investor-visa models that required job creation or risky investments in private projects. Instead of investing in a business, Gold Card applicants contribute directly to the U.S. Treasury through the Department of Commerce. How the Gold Card Works Here’s how the process is expected to unfold: Application: Interested individuals submit an application through the official government portal. Vetting: Each applicant goes through national security and background checks. Contribution: Once approved, the applicant makes an unrestricted $1 million (or $2 million corporate) contribution to the U.S. Department of Commerce. Confirmation: The funds are placed in a special federal account dedicated to commerce and industry. Residency Granted: After verification, the applicant receives a fast-tracked green card under existing employment-based visa categories. The contribution is considered a “gift,” not an investment — meaning it’s non-refundable and does not require job creation or business risk. How It Differs from Previous Programs Before the Gold Card, the main path for wealthy immigrants was the EB-5 Immigrant Investor Program, which required a minimum $800,000 investment in a U.S. business that created at least 10 jobs. The Gold Card removes those conditions entirely. There’s no need to create jobs, choose a specific region, or manage a project. The money goes straight to the U.S. government, which makes the process far simpler but also far more controversial. Another key difference is the tax treatment. The proposed Platinum tier could allow recipients to spend up to 270 days per year in the U.S. without being taxed on foreign income — something no previous visa program has offered. Benefits and Opportunities Supporters of the Gold Card say it’s a smart way to attract global wealth and high-value individuals who can contribute to the American economy. Potential advantages include: A major new revenue stream for the federal government. Easier and faster residency options for investors and entrepreneurs. New opportunities for companies to sponsor elite employees under the corporate version. Potential to make the U.S. a global magnet for wealthy business leaders seeking stability and prestige.

Read More →